A Mini Tokyo Tech Week, Cross-Border Relations, and Overseas Investments

Most of the local startup ecosystem in Tokyo is going to be recuperating this weekend from a series of tech events that inadvertently constituted a mini Tokyo Tech Week - feels like there might be a case to brand it as such!

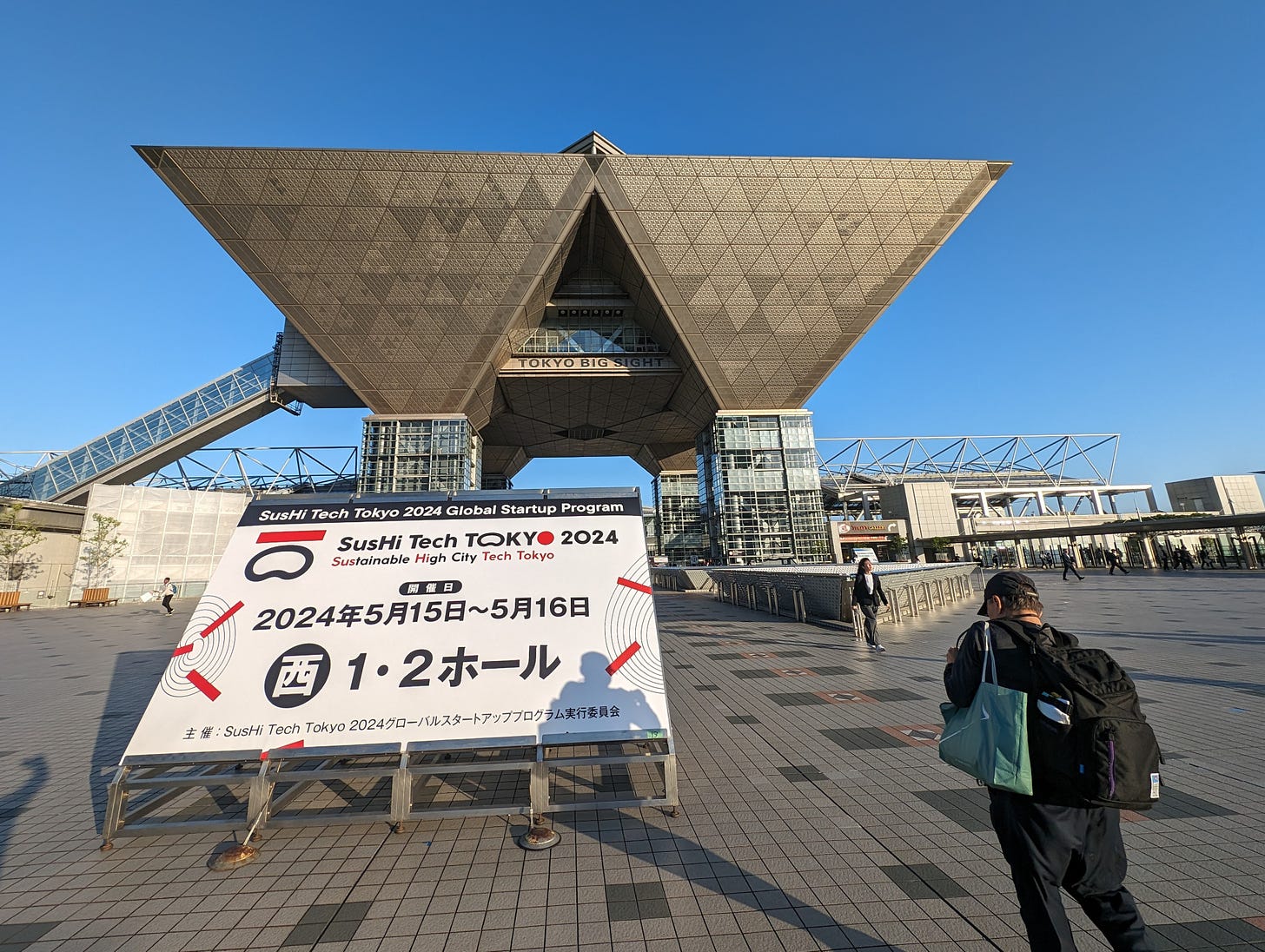

The week was headlined by SusHi Tech Tokyo 2024 - a large-scale conference organized by the Tokyo Metropolitan Government boasting over 40,000 participants, 3,000 exhibitors, and a butt-ton of corporate sponsors. While not the grassroots initiative of our dreams, our personal sense here is that it represents the prioritization of and significant resource allocation towards supporting the startup ecosystem, as detailed in Tokyo’s catchy Global Innovation with STARTUPS (10x10x10) plan.

From a macro perspective, perhaps equally as important as the material support that existing startups get from all of this frenetic activity is arguably the official narrative that startups are now *the thing* to do here and normalizing founding and working at startups. A reference point for this would be the push to develop the startup ecosystem in France over the last decade which has spawned 25,000 startups and 30 unicorns.

On this note: there were a couple of sessions and speakers that we felt were particularly worth highlighting. We’re sure this is just scratching the surface, so am curious to see what else people got from it.

Marc Penzel - Founder & President @ Startup Genome

Michael Jackson - Venture Partner @ Wilbe

Tomoko Namba - Keidanren Vice Chair / Founder @ DeNA / Delight Ventures

John Roos - Founding Partner @ Geodesic Capital / Former U.S. Ambassador to Japan

Marwan Elfitesse - Head of Startup Programs and Business Services @ Station F

Ravi Belani - Managing Director & CEO @ Alchemist Accelerator

Eriko Suzuki - Founder & CEO @ Kind Capital

On a parting note this week - there’s a great community startup calendar in Luma that does a good job keeping track of both English and Japanese language events in Japan.

There’s quite a bit going on that we haven’t covered here, most notably the Startup Japan 2024 event which was held in parallel to SusHi Tech at the same venue on the same dates, as well as AiSalon Tokyo, an online pitch event connecting Japanese startups with top global VCs such as Coatue, DST, and Pear VC amongst others, and a visit by the CMO of Duolingo.

And onwards to the news of the week!

The Headlines

Korea-Japan Venture Summit 2024 To Enhance Cross-border Collaboration with $100 Million Joint Fund (KoreaTechDesk)

Japan's foreign aid to focus more on tech, less on infrastructure (Nikkei Asia)

Japan, the U.S. and others to ease cross-border personal data transfers (Nikkei Asia)

Japan Team Develops AI Foundation with Fugaku Supercomputer (The Japan News)

Japan companies kept $68bn of overseas profits abroad (Nikkei)

Deep Dives

Korea-Japan Venture Summit 2024 To Enhance Cross-border Startup Collaboration with $100 Million Joint Fund

The Korean Ministry of SMEs and Startups hosted the 'Korea-Japan Venture and Startup Investment Summit 2024' in Tokyo on May 10, marking a significant step in strengthening bilateral cooperation between the two countries' startup ecosystems. The event featured over 150 attendees, including government officials, venture capitalists, and startups, and was divided into segments focused on investment cooperation, startup presentations, and a corporate venture capital (CVC) summit.

Minister Oh Young-joo announced the launch of the first joint Korea-Japan venture fund, totaling $100 million (KRW 138 billion), involving contributions from both governments and private investors.

The fund will invest a minimum of $5 million in Korean companies, aiming to foster cooperation in venture investment policies and provide local investor networks for Korean startups entering the Japanese market.

The "K Global Star" program was unveiled, offering support for Korean startups at all stages of investment attraction and featuring initiatives such as global tips and technology guarantees.

A memorandum of understanding (MOU) was signed between the Korea CVC Council and Japan FIRST CVC, facilitating future collaborations, including joint IR events and support for startups expanding into both countries.

More in-depth coverage can be found here by Norbert Gehrke of Tokyo Fintech.

Japan's foreign aid to focus more on tech, and less on infrastructure

The Japanese government plans to shift its foreign aid focus from infrastructure development to advanced technologies such as AI and quantum computing. This change, recommended by an expert panel and to be submitted on Thursday, aims to address sustainability issues in emerging economies through science and technology, positioning Japan differently from China's infrastructure-heavy aid approach.

The expert panel will recommend revising the ODA program to emphasize technology, with recommendations submitted to Foreign Minister Yoko Kamikawa on Thursday, and provisions included in the fiscal 2025 budget request this summer.

Japan aims to help developing countries tackle issues like infectious diseases, disaster prevention, and aging populations using advanced technologies, including deploying quantum technology for earthquake simulation.

The government plans to simplify the collaborative research process, making it easier for researchers to engage in joint projects, addressing calls to streamline the numerous preliminary screening steps.

Japan's ODA budget for fiscal 2024 is set at 565 billion yen ($3.63 billion), significantly down from the peak of 1.16 trillion yen in fiscal 1997, indicating a strategic pivot from traditional infrastructure projects to fostering technological development in emerging economies.

Japan Team Develops AI Foundation with Fugaku Supercomputer

A team of researchers from the Tokyo Institute of Technology, Fujitsu Ltd., and others have developed a large language model called Fugaku-LLM, using the Japanese supercomputer Fugaku. Trained primarily on Japanese data, this model aims to advance research on generative AI tailored to domestic needs.

The project, launched in May 2023, includes collaborators from Tohoku University, Nagoya University, Riken, CyberAgent Inc., and Kotoba Technologies Inc.

Fugaku-LLM demonstrates high proficiency in Japanese, fluently answering questions about haiku by Matsuo Basho.

Unlike other models, Fugaku-LLM is trained from scratch with carefully selected data, ensuring transparency and safety.

The model was trained using central processing units (CPUs) instead of the commonly used graphics processing units (GPUs), which are in short supply globally.

Japan companies kept $68bn of overseas profits abroad

Japanese corporations reinvested 10.57 trillion yen ($67.8 billion) of overseas profits abroad last fiscal year, more than triple the amount a decade ago, according to new government data. This trend is contributing to the yen's historic lows, prompting the Japanese government to consider tax incentives to encourage the repatriation of these offshore profits.

Japan's current account surplus reached a record 25.34 trillion yen in fiscal 2023, driven by a primary income of 35.53 trillion yen.

Despite the increase in overseas income, 51% of direct investment profits were reinvested abroad to avoid foreign exchange risks and currency conversion fees.

The Finance Ministry launched an expert panel in March to discuss this trend, with some members concerned about the lack of domestic investment and wage growth from overseas profits.

The government is considering tax incentives to encourage converting overseas profits into yen, while the Tokyo Stock Exchange's focus on capital efficiency may also contribute to strengthening the yen.

Word on the Street

Fundraising Highlights

Last week was a bit slow due to the Golden Week holiday

Crassone, a web service for bulk estimation of demolition work, raised a ¥1.2B JPY (~$7.8M USD) Series C round from EEI, JP Investment, Animal Spirits, and Daiwa House Group

Money Design, a discretionary investment management service using AI-equipped robo advisors, raised an undisclosed Series E round from Tokai Tokyo Financial Holdings

Lynx, a startup that develops and provides "shikAI", a product that provides highly accurate navigation for visually impaired users, raised an undisclosed Series B round from QR Investment

Aeterlink, a Standford University startup that is building long-range WPT (AirPlug™︎) technology, raised a ¥500M JPY (~$3.2M USD) Series B round led by JAFCO Group and participated by SMBC Venture Capital, Mizuho Capital, Mitsubishi UFJ Capital, ITOCHU Technology Ventures, Keio Innovation Initiative, and others

E-thermogentech, a startup that develops a thin and flexible thermoelectric power generation module, raised an undisclosed Series B round from Sanin Oxygen Industry

Bywill, a startup that provides solutions to support companies' efforts toward decarbonization, raised a ¥180M JPY (~$1.1M USD) Series A round from QR Investment SMBC Ventures, Iyogin Capital, Hirogin Capital Partners, Mitsubishi UFJ Capital, Gifu Shinkin Bank, Kiyo Bank, Higin Capital

Aidot, a startup that provides a new biometric authentication solution, raised an undisclosed Series B round from AZ-COM Maruwa Holdings

Tigereye, a data matching and optimization platform, raised an undisclosed Seed round from GENZ

More Food for Thought

Some additional reads from the week -

Japanese Companies Introduce the First Ever 6G Device – 500X Faster than 5G (The Tech Report)

Foreign workers in Japan climb the ladder at smaller firms (Nikkei Asia)

Meta Ready to Testify at Japan's Parliament over Scam Ads (Nippon.com)

South Korea stresses need for fair treatment for Line chat app operator Naver (Source One)

Intel assembles Japan team for chipmaking automation (Nikkei Asia)

Goldman Tops Investment Banks Reaping Windfall in Tokyo (Bloomberg)

Japanese Entrepreneur in U.S. Stresses Need to Study Abroad; Govt Working to Expand Scholarships to Support Students (The Japan News)

Japan’s big banks forecast record profits, signal new optimism (Business Times)

Notes from the Team

Thanks for reading and hope to see you around around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)