Currency Interventions, Activist Investors, and Empty Houses

Can’t afford to buy a house where you live with sky-high interest rates and artificially constrained supply? Just come to Japan and get a house for free!*

*terms and conditions may apply

Similar to their peers across the world, the urban metropolises of Japan are known for being crowded - shoulder-to-shoulder trains cars, cramped apartments, and teeming tourist traps. People mountain people sea! People everywhere!

Conversely, the rising numbers of akiya - uninhabited and often abandoned houses - across the country tell the opposite story. It’s almost a cliché to see news articles about free houses in Japan on the internet, but the relevance of the issue continues to rise.

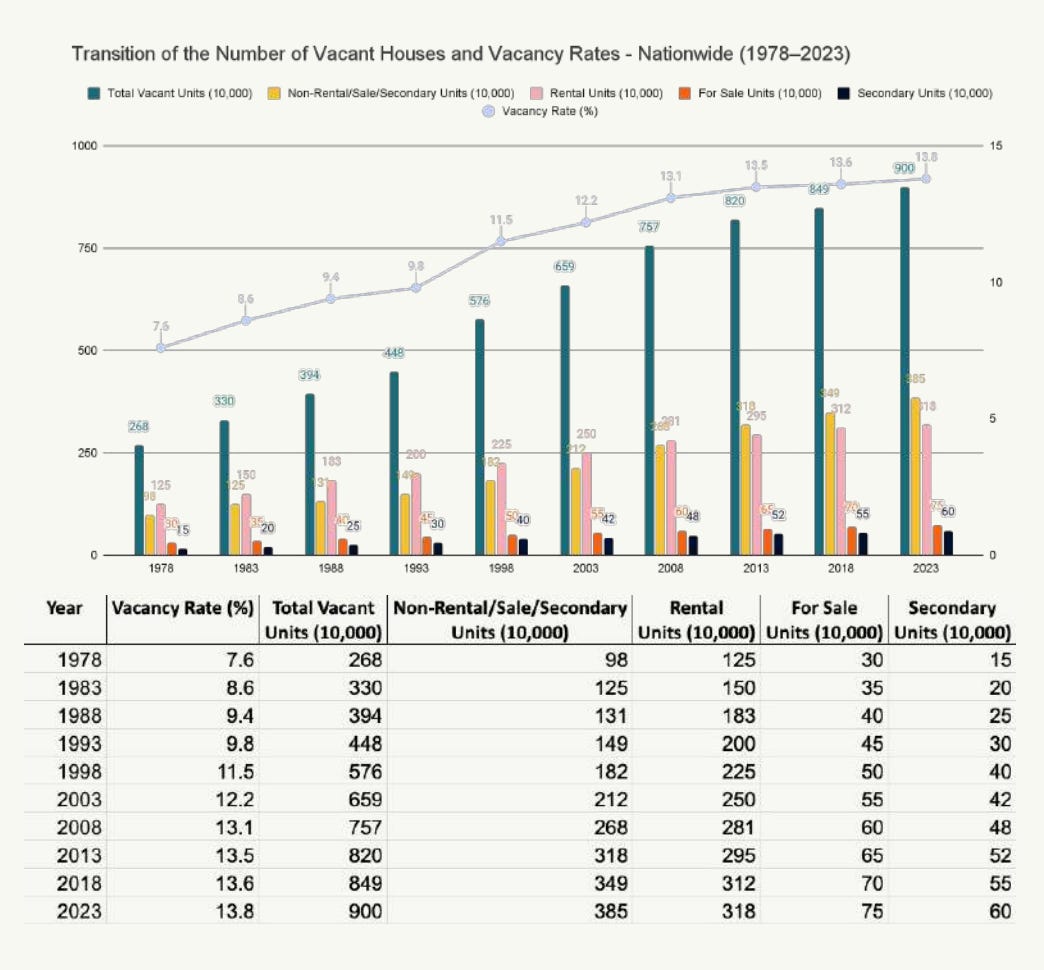

According to a recent survey by the Ministry of Internal Affairs and Communications, there were 8.99 million vacant homes in Japan as of last October, an increase of 500,000 from the previous survey conducted five years ago - currently accounting for 13.8% of all homes in Japan. Not surprisingly, rural areas see the highest vacancy rates - the prefectures of Wakayama and Tokushima prefectures, for instance, have 21.2% of their total housing stock unoccupied - 1 out of every 5 homes!

Moreover, the issue of abandonment extends beyond residential buildings to include a significant amount of unclaimed land: on 2016, there were an estimated 4.1 million hectares of unclaimed land, representing about 11% of the total land area of Japan - an area larger than the island of Kyushu.

Meanwhile, companies and regulatory changes are emerging to address the problems and opportunities. And perhaps relevant to policymakers and astute entrepreneurs elsewhere - is this a harbinger of things to come for the rest of the world?

The Headlines

Japan used $59bn to prop up the yen to ~¥156

70% of Japanese blue chips saw an increase in profits

Elliott's Sumitomo stake shows Japan's growing activist investor trend.

Honda to join forces with Japan taxi companies on driverless service

Deep Dives

Japan likely spent $59bn to prop up the yen to ~¥156

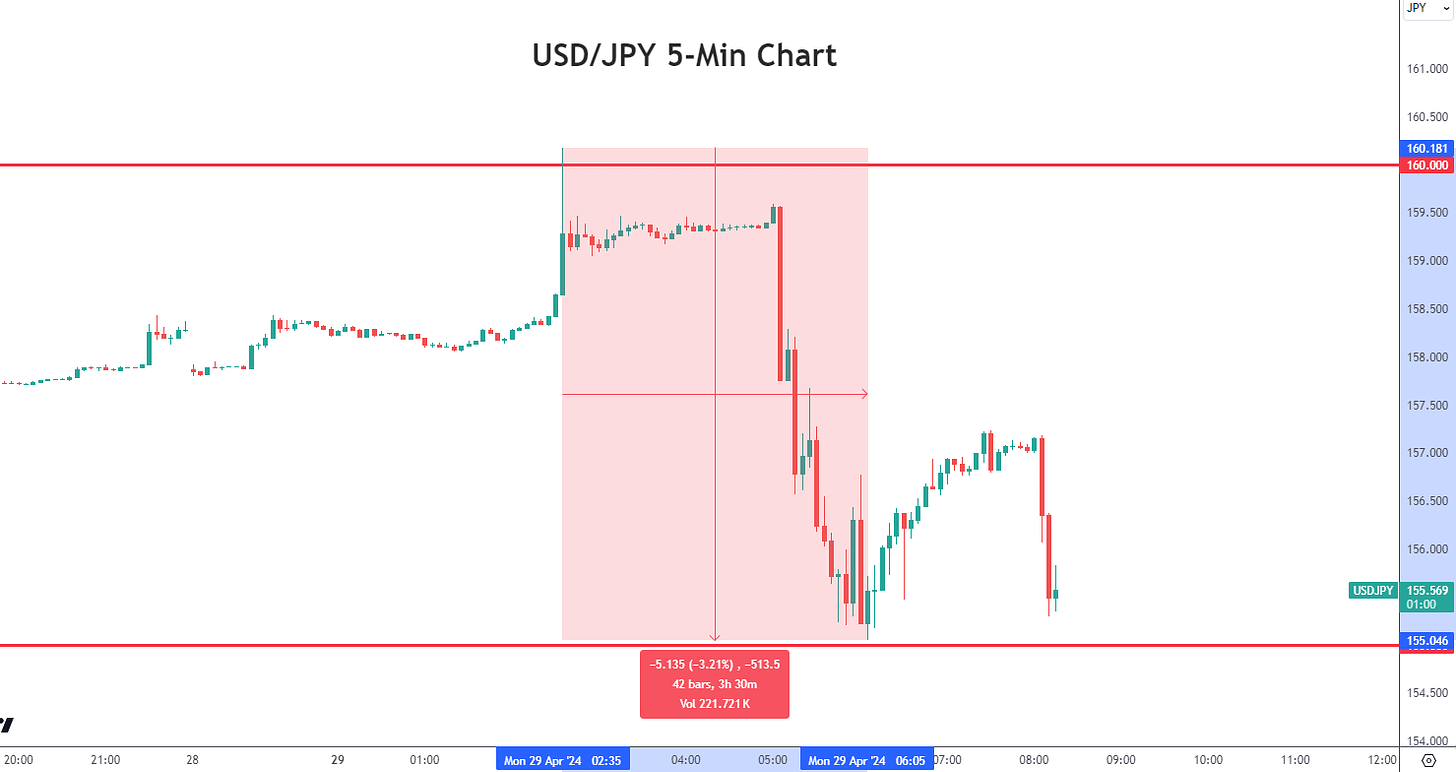

The yen experienced a notable appreciation on Monday, swiftly moving from over 160 to around 155 against the dollar, sparking widespread speculation of a possible intervention by Japanese authorities to stabilize the currency. This move came after the yen hit a 34-year low earlier in the day, leading to concerns about rising import prices and inflation due to the weakening yen.

Japan typically intervenes in the currency market by either selling dollars to buy yen, to counteract an excessively weak yen, or selling yen for dollars to manage an excessively strong yen. These operations are primarily executed by the Bank of Japan (BOJ) on behalf of the Ministry of Finance.

There is recent precedent - In 2022, Japan intervened three times between September and October, spending approximately 9.2 trillion JPY ($59.1B USD @ today’s exchange rate). These interventions were strategically timed to maximize impact and included both unilateral actions and coordinated efforts with other countries.

While interventions like the one in September 2022 are sometimes announced immediately, others, such as one in October, are not disclosed right away. This practice of "stealth interventions" aims to minimize speculative trading and prolong the intervention's effectiveness, with details released at the end of each month or quarterly.

Honda to join forces with Japan taxi companies on driverless service

Honda Motor is set to collaborate with Japanese taxi companies to introduce self-driving cabs in Tokyo by 2026, marking a strategic departure from the more integrated approach seen in U.S. and Chinese markets where companies like Waymo and Baidu both develop and operate robotaxis. This partnership with Teito Motor Transportation and Kokusai Motorcars involves Honda providing vehicles and technological systems while the taxi companies manage operations.

Honda's model involves supplying the taxis with Level 4 autonomous driving capabilities, supported by a comprehensive package that includes ride-hailing apps and remote monitoring to ensure safety under regulatory conditions that require human oversight.

The collaboration aims to address operational and safety challenges by leveraging the existing infrastructure and expertise of traditional taxi operators, thereby lowering the barriers to entry and potentially reducing costs.

Regulatory and liability issues present significant hurdles, as Japanese law requires specific handling of remote monitoring and holds taxi companies accountable for accidents, prompting discussions about potential regulatory reforms.

The autonomous taxis will utilize the Cruise Origin, a vehicle developed jointly with General Motors and its subsidiary Cruise, lacking a driver's seat, to test the feasibility of this innovative transport solution with an initial rollout of about 500 cars.

More than two-thirds of major public Japanese companies reported an increase in profits

Profits have risen at more than two-thirds of major Japanese public companies for the fiscal year ending in March, buoyed by factors like a weaker yen, strategic price increases, and a surge in tourism. A review of 173 companies listed on the Tokyo Stock Exchange's Prime market by Nikkei showed that 69% reported higher profits, a significant jump from the previous year.

Industries such as rail, air freight, food, and machinery have seen profit increases, benefiting from the lifting of COVID-19 restrictions and easing semiconductor shortages. This broad industry performance has contributed to a 27% increase in total reported net profits, totaling 11.75 trillion yen ($74.56 billion).

Of the companies providing fiscal 2023 profit projections, 75% surpassed these forecasts, contributing to an overall better-than-expected corporate performance. Notably, about 60% of the 104 companies analyzed exceeded QUICK Consensus estimates by analysts.

The boom in GenAI has spurred increased demand for semiconductors and related technologies, significantly boosting profits for companies like Disco and Socionext. Additionally, the recovery in tourism and the ability of companies like Mitsubishi Electric and Komatsu to pass on rising costs through price hikes have been crucial for profit growth.

Despite the current profitability, fiscal 2024 forecasts suggest a potential 6% decline in net profits. Rising labor and energy costs, coupled with the impact of a weak yen on companies like Tokyo Gas, pose challenges for sustaining this growth, emphasizing a potential divide between companies that can and cannot pass on costs effectively.

Elliott's Sumitomo stake shows Japan's growing activist investor trend

Elliott Management, a well-known activist investment firm - has reportedly acquired a significant stake in Sumitomo Corp., one of the Japanese trading houses favored by Warren Buffett. Recent trends highlight Japan’s increasing attractiveness for international activist investors, who are encouraged by governmental and institutional pressures to enhance shareholder returns.

Elliott has actively engaged with Sumitomo to discuss strategies for increasing shareholder value, although specific details of the stake acquisition and discussions remain undisclosed. The company’s approach aligns with a broader trend where activist investors push for more aggressive management of assets and shareholder-friendly policies.

The impact of such activism is evident in the performance of Japanese trading houses' stocks, which have surged to record highs following Buffett's endorsement of their shareholder-friendly practices. Sumitomo's shares have notably risen by 27% this year.

In response to activist pressures, other firms in the sector, such as Mitsubishi and Itochu, have announced substantial stock buyback plans, reflecting a trend towards enhancing shareholder returns. Sumitomo is set to announce its fiscal 2023 earnings and a medium-term business plan that may further reflect these investor-driven changes.

Word on the Street

Fundraising Highlights

Last week was a bit slow due to the Golden Week holiday

Two Cells, a Hiroshima University startup that develops a knee cartilage regeneration cell therapy, raised an undisclosed Series B round from Hometown Collaboration Support Fund

Mnes, a cloud-based medical data-sharing platform, raised an undisclosed Series B round from Medipal Innovation Investment

Aero Next, a next-generation industrial drone manufacturer, raised an undisclosed Series A round from Yamanate

Toyoko, a manufacturer of the “CoolLaser”, which uses a laser to remove rust and paint from aging infrastructure raised a ¥250M JPY (~$1.6M USD) Series D round from Resona Capital, and the Decarbonization Support Organization

New Green, a Tokyo University startup that develops automatic weed control robots for rice fields, raised an undisclosed Series A round from Chubu Electric

More Food for Thought

Some additional reads from the week -

Japanese space debris removal startup Astroscale Holdings files for IPO, eyes $580M valuation (The Bridge)

Climate change, chalky grains and the risks for Japan’s rice farmers (Japan Times)

Uniqlo parent aims for 80% of managers to be non-Japanese by fiscal 2030 (Nikkei)

Tokyo stocks open higher as tech shares track US gains (Mainichi)

Toyota's $9.9B 'Robo City' Near Mt. Fuji Almost Ready To Welcome 2,000 (IBT)

Osaka governor suggests lowering voting age to 0 to curb population decline (JT)

'Engineer/programmer' ranked No. 1 dream job for the 1st time (Mainichi)

World's 1st 'tooth regrowth medicine' to be tested in Japan (Mainichi)

Tokyo startup devises AI system to help with endoscopic surgery (Nikkei)

Ono Pharma. acquires cancer-focused biopharma Deciphera for $2.4bn (Yahoo)

Notes from the Team

Thanks for reading and hope to see you around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)