Growing Foreign Interest In Japan

BlackRocks' Larry Fink on Japan, Reddit Co-Founder Alexis Ohanian bets on Japanese chips, and Initial releases its 2024 Startup Report.

As reported last week, The Bank of Japan finally hiked the policy rate to *drum roll* 0%-0.1%!

Which, while incredibly modest compared to the rest of the world, has significant implications for Japan and brings us to a fun discussion topic this week: zombie companies - indebted firms barely able to cover interest payments with their cash flow despite rock-bottom rates.

Why is this a big deal?

Access to cheap and easy loans in Japan for the last several decades have allowed uncompetitive and unprofitable companies to stay afloat indefinitely - while this has had the benefit of reducing short-term employment, it’s also been a significant drag on productivity and investment, particularly for SMEs.

Labor productivity for SMEs in Japan is estimated to be *45%* that of larger companies - with many of these companies unable to invest in equipment, staff training, higher wages, or R&D.

According to Tokyo Shoko Research, a credit reporting agency, approximately 565,000 "zombie" firms in Japan are currently grappling with debt repayment. A mere 0.1 percentage point rise in interest rates would escalate this figure by approximately 12% to 632,000.

This looming surge suggests an imminent wave of bankruptcies in the coming months - the number of corporations that went bankrupt in 2023 increased by 35.2% compared to a year before to 8,690 companies, even before the recent interest rate hike.

This is likely a good thing in the long-run! Demographics and staffing shortages are increasing labor market fluidity, so this should lead to a better allocation of talent and resources to more productive and profitable companies.

The Headlines

Globis Capital x Initial - Startup Report Key Takeaways

BlackRock’s Larry Fink on Japanese Stocks

Reddit Co-Founder Alexis Ohanian bets on Japan-U.S chip Alliance

“Japan Should build its own AI” - Nvidia Jensen Huang

Redefining AI Models with Sakana AI

Deep Dives

Globis Capital x Initial - Startup Report Key Takeaways

Here are the key highlights from the annual report jointly published by Globis Capital Partners and Initial, reflecting on Japan's startup landscape in 2023:

VC financing increased by 10x in the last 10 years, and Japanese corporations have shown increasing openness and proactivity in working with startups

In 2023, Japanese startups raised an estimated ¥850 billion JPY (~$6 billion USD) - a slight decline from the previous year (¥874 billion JPY), but still robust.

32 startups raised funds exceeding ¥3 billion JPY (~$21 million USD), while 8 more raised over JPY ¥10 billion (~$71 million USD).

Although these figures still lag behind those seen in the U.S. market (for instance, Oishii Farm alone raised over $130 million USD in a Series B round in the U.S), we anticipate further acceleration, especially given the Japanese government's ambitious plan to allocate ¥10 trillion JPY (roughly USD $60 billion), to propel Japanese startups to comparable levels seen internationally.

The Emerging Generation of Japanese Workers Want to Work for Startups

Japan’s reputation for a traditionally risk-averse culture - with top talent gravitating towards government ministries and established large corporations - has begun shifting, with students and younger workers expressing a greater preference for working at startups.

It has become a new norm for top university students to work for a startup as an intern. Many startups have student interns from top universities and some join full-time upon graduation

Growing Number of Japanese Unicorns

In 2023, Japan boasted 7 unicorns - a notable increase from several years ago. Historically, Japanese startups have tended to go public early at a valuation of ¥10-30 billion JPY (approximately $71-214 million USD). This is partly because the Tokyo Stock Exchange Growth Section - previously known as the Mothers Section - is more accommodating for earlier-stage IPOs compared to other stock exchanges globally.

Nevertheless, as startups are increasingly able to secure growth financing from private markets, Japanese startups will be incentivized to aim for greater business growth before considering an IPO.

Unicorns are present across a range of industries - with SmartNews (consumer news aggregation), SmartHR (HR SaaS), Spiber (material science), TBM (materials science), and Astroscale (space tech) as examples of this trend.

IPOs have rebounded, but M&A activity is still low

IPOs over ¥100 billion JPY (approx. $711 million USD) and M&As over JPY 10 billion (approx. USD 71 million) are becoming more common.

The IPO market experienced a rapid rebound, with 49 startups going public, and some of them making strong debuts in the public market. For example, Cover, a next-generation media and metaverse company, realized an initial market capitalization over JPY 100 billion (approx. USD 711 million). Meanwhile, ispace, a space technology company, and GENDA, a global entertainment venture have continued to see robust stock price growth after going public.

M&A, on the other hand, maintained their 2021-2022 level at around 100 companies, which we anticipate to grow as corporates look to increase M&A activity this year.

BlackRock’s Larry Fink on Japanese Stocks

Larry Fink of BlackRock highlights Japan's economic recovery and potential in the stock market, noting that Japanese stocks are comparatively inexpensive and have more upside due to the quality of companies and their earnings.

Fink emphasized Japan's economic "turning point" and the appeal of Japanese stocks on a dollar basis, considering the yen's depreciation.

The revitalization of Japan's economy is supported by new investment incentives, such as the Nippon Individual Savings Account (NISA), and a shift towards positive interest rates after nearly two decades.

BlackRock maintains an overweight position in Japan, encouraged by policy shifts and increased individual investor participation, signaling economic optimism.

Additionally, Fink comments on the U.S. Federal Reserve's appropriate actions and dismisses political influences on its decisions, while praising U.S. equity markets for innovation-driven growth.

Reddit Co-Founder Alexis Ohanian bets on Japan-U.S chip Alliance

Alexis Ohanian, co-founder of Reddit and Seven Seven Six - an early-stage venture capital firm - outlined plans to invest in tech startups in Japan. He highlighted a focus on “companies developing particular processors for artificial intelligence” and positioning of the country in international supply chains.

His venture firm, Seven Seven Six, with $970 million in assets, targets early-stage startups, noting Japan's strategic importance in a shifting global semiconductor landscape.

The move aligns with U.S. efforts to bolster a China-independent semiconductor supply chain, highlighting Japan's role and recent investments by major tech firms.

Speaking on the sidelines of a startup event by X&KSK, Ohanian opined that "the question I like asking is, what will not be different in 10 years? And what [and] where we can invest our time or money. And the relationship between the United States and Japan should be even stronger 10 years from now."

“Japan Should build its own AI” - Nvidia Jensen Huang

Nvidia CEO Jensen Huang advocated for Japan to develop its own AI models at its annual GTC conference, emphasizing the significance of leveraging local data and cultural specificity to enhance productivity, especially in an aging society. This follows reports that Nvidia plans on opening an R&D center and investing in local startups in Japan.

Huang highlighted the importance of Japan creating its own AI technologies to utilize its unique language, culture, and data, avoiding dependency on imported AI solutions.

With Japan's focus on improving productivity amidst an aging population, AI is seen as a key tool, motivating the country to invest in domestic AI development.

Nvidia, recognizing the growth of "sovereign AI" in Asia, is keen on supporting countries like Japan and India as they build their computing infrastructure and develop large language models.

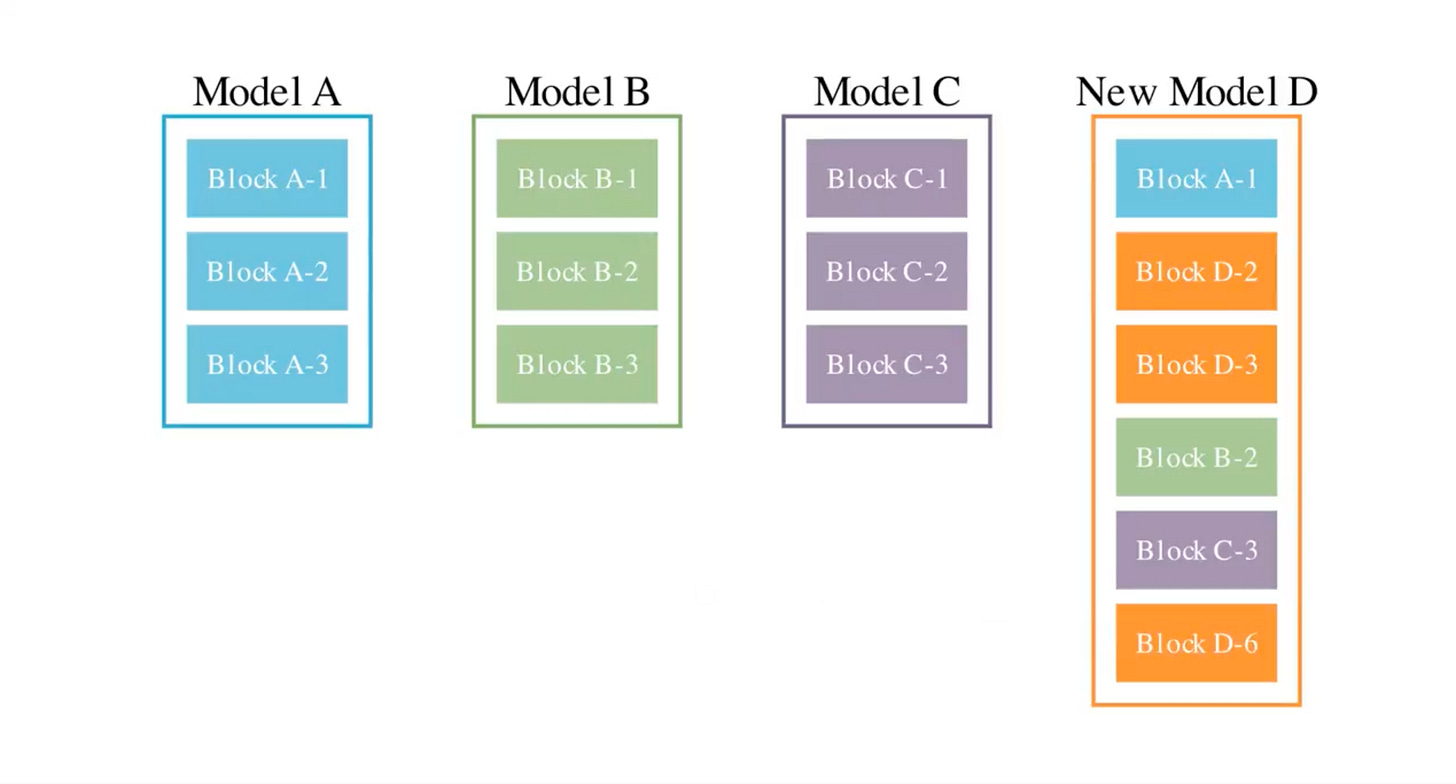

Evolving AI Models with Sakana AI

Sakana AI, a Tokyo-based AI startup, announced the release of Generative AI models based on concepts derived from evolution and natural selection to reduce cost and development time. This nature-inspired approach, hailed as a first, yielded three AI models: a large language model, an image-to-text model, and an image generation model.

Sakana AI used an evolutionary algorithm that "bred" over a hundred AI "offspring" from three open-source models, refining them across several hundred generations to select the most efficient outcomes.

This process, which involves automatically merging the best AI models, contrasts with the traditional, labor-intensive method of manual merging, showcasing a novel, efficient development strategy.

The startup, founded by former Google researchers, developed its AI models in a day at minimal cost, presenting a cost-effective alternative to the expensive and time-consuming development of large language models like OpenAI's GPT-4.

Sakana AI's approach signifies a new direction in the competitive landscape of generative AI, focusing on creating specialized models for specific tasks, a departure from the trend towards developing versatile generalist systems.

Word on the Street

The Prime Minister popping in (virtually) as a headline speaker for a startup event organized by a football star-turned-investor and a former startup CFO highlights the need for a more active M&A market in Japan.

Translation:

“It reduces small IPOs, increases the number of entrepreneurs, and contributes to the continued growth of listed companies. There is such a magic measure...it's called M&A. When you do this, the threshold for going public is raised, entrepreneurs can go back to bat, and it contributes to the growth of the acquiring side. Of course, the effect is halved with small M&A, but even so, what Japan needs now is M&A, not IPOs, or the current ecosystem will collapse (I don't know about that).

To begin with, Japan already has about 1 trillion yen/year in VC investment (it will drop in 2023, but will return soon due to the trend of fund formation and the tailwind of the 5-year plan to nurture startups). It is very crude, but if the VC ratio is 1/3 and the expected return is 3x, you would need to create a valuation of 9 trillion yen. The problem here is the exit strategy. In Japan, the overwhelming focus is on IPOs, but there are at most 100 per year. This, combined with the capacity of auditing firms and securities firms, places very strict constraints on the number of IPOs. If the number of IPOs stays the same, we need all IPOs to be under 100 billion yen to make 9 trillion. By the way, do you guys know the market capitalization of the growth market? It is roughly 7.7 trillion yen. In other words, it is the same scale as building the entire growth market every year!

M&A will be the solution to this (not saying all). Of course, it is less effective on a small scale, but M&A is less restrictive on the number of cases than going public in the first place. And entrepreneurs who are able to exit quickly can go to bat and create a new company. Also, as is clear from the Tech Giants in North America, it is almost impossible to maintain high growth without M&A. They have made over 100 acquisitions in both established and new business areas since their inception.

So, I don't deny IPOs at all, but I think that more M&As would be good for the startup ecosystem as well as for the market capitalization of Japan Inc. That's what I was talking about!”

Fundraising Highlights

Elyza, a University of Tokyo-based startup building ELYZA LLM, the largest domestic LLM measured by the number of parameters, in Japan, raised an undisclosed Seed round from KDDI.

HIF, a startup developing payment, credit guarantee, and loan solutions raised an undisclosed Series D round from Hoover Investment.

Desamis, a cow behavior monitoring system provider, raised a ¥440M JPY (~$2.9M USD) Series C round from ENEOS Innovation Partners, RKB Mainichi Holdings, Robot Home, Kakuichi, Scalar, Ricoh Lease, Azusa Research Institute, and Tsuzuki Ikuei Academy.

Frontier Field, a startup that developing a smartphone app-based communication solution for hospitals called "Nichibyou Mobile," raised an undisclosed Series C round from Terumo.

JPYC, a cryptocurrency startup that issues and sells a Japanese yen-linked stable coin - JPYC (JPY Coin) - raised an undisclosed Series A round from Persol Ventures Partners.

More Food for Thought

Some additional reads from the week -

Secrets of Japanese urbanism - A review of "Emergent Tokyo" (Noahpinion)

In Japan, even Taylor Swift can't make it to the top of the music charts (Nikkei Asia)

Airbnb Japan launches unsecured ‘Home-Sharing Loan’ to renovate abandoned houses in partnership with a financial service provider (Travel Voice)

McDonald's Japan chair Sarah Casanova to step down (Nikkei Asia)

Japanese megabanks dominate top 3 in global CVC investments (Nikkei)

Hong Kong's loss can be Tokyo's gain if it plays its cards right (Nikkei)

Startups from Kanagawa Prefecture solving Japan's social issues (JP)

Notes from the Team

Thanks for reading and hope to see you around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)