JAXA Launches a $6B Space Fund, KKR Eyes Real Estate Opportunities, and JAFCO's SV7 Fund Performs.

And it's Golden Week!

From the perspective of someone who has lived in Japan for a while, purveying popular discourse on the country can be a fascinating sensation - sort of like looking at a funhouse mirror reflection of the house you live in. There are bits and pieces that you recognize, but the image is ultimately an exaggerated caricature of the real thing.

I’m sure this is an experience familiar to anyone who lives in any country that looms large in the popular global imagination, but it feels particularly acute for Japan: tropes dating from the 90s or earlier seem to have a particularly long shelf life.

Which brings us to this week’s fun fact on - *drumroll* - immigration.

Over the course of the past week, I’ve encountered at least a dozen comments on social media posts claiming that Japan makes it impossible for foreigners to move to Japan. Nothing could be further from the truth!

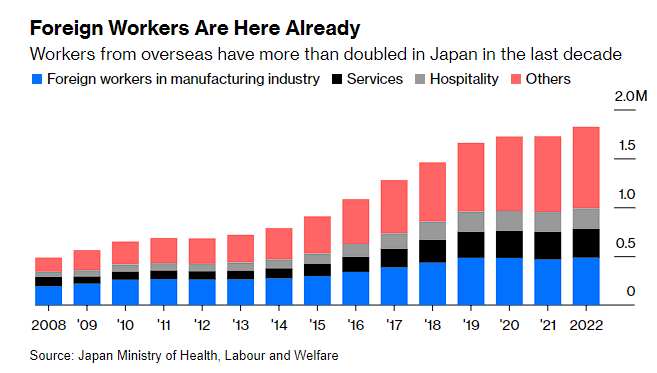

Over the course of the last 15 years, the number of foreign workers in Japan has more than quadrupled - increasing from 486,000 in 2008 to 2.05 million in 2023 - with growth accelerating to 12.4% y-o-y in 2023 compared to 2022!

In addition, recent surveys indicated that 86% of municipalities wanted more foreign workers, with 70% of individuals indicating a belief that increasing the number of foreign residents was generally a good thing. This belief also seems to be relatively widespread across age groups, albeit with the youngest respondents indicating the most positive sentiment towards foreign residents.

One notable point here is that the increase in foreign workers has corresponded with a dramatic fall in the number of reported crimes to almost 1/4 of its peak - defusing a narrative that immigration results in greater social disorder, and potentially one reason as to why a political backlash has largely not materialized despite quickly changing social realities in Japan.

This isn’t to say that there aren’t a number of issues to be worked through, but the *narrative* about xenophobia seems awfully out of date given broadening acceptance and regulatory changes expanding and adding visa categories with a path to permanent residency across the board. Even if the U.S. President says so.

Anyway - back to our regular programming on startups, tech, and investing!

The Headlines

TSE Prime's market cap nears ¥1 quadrillion two years after shake-up

Japan’s Oldest VC Firm Eyes 200% Gain as Unicorns Proliferate

Japan Gov Partners with JAXA to Launch $6 Billion Space Fund

KKR “How Japan’s Economic Reawakening Is Creating Real Estate Investment Opportunities”

Deep Dives

TSE Prime's market cap nears ¥1 quadrillion two years after shake-up

The Tokyo Stock Exchange's Prime section has seen significant growth in market capitalization, which has approached ¥1 quadrillion following a major reorganization two years ago. This restructuring, which consolidated the former first section and other segments into three new categories—Prime, Standard, and Growth—has helped to increase the market value of the Prime section by 40% despite a 10% reduction in the number of listed companies.

The total market capitalization of the Prime section surged from about ¥680 trillion in April 2022 to approximately ¥970 trillion by the end of the last month, influenced heavily by foreign investment.

The restructuring initially allowed all first-section companies to join the Prime section, regardless of whether they met the new criteria. This policy was later revised to move companies that failed to meet standards to the Standard section without additional screenings.

While the TSE aims to enhance the value of companies listed on the Prime section, the average market capitalization per company remains significantly lower than those on major exchanges like the New York Stock Exchange. The exchange continues to encourage firms to improve capital efficiency and disclose detailed investment plans for growth.

The average market capitalization of companies in the Prime section still remains below ¥600 billion JPY ($3.8 billion USD), significantly lower than that of companies listed on the New York Stock Exchange.

Japan’s Oldest VC Firm Eyes 200% Gain as Unicorns Proliferate

Jafco Group Co., Japan's oldest venture capital firm, is nearing its goal to triple the investment value of its latest SV7 fund, in a sign of momentum in Japan’s startup ecosystem. The fund is poised to achieve a return of 200% or more, driven by its portfolio companies expanding internationally and achieving higher valuations.

Jafco is planning to launch a new Japan-focused fund of at least ¥100 billion ($640 million) next year, overseeing around ¥466 billion in assets currently.

The firm is benefiting from a surge in potential unicorns in Japan, supported by a new generation of entrepreneurs and skilled workers from established companies, contributing to a transformative business environment.

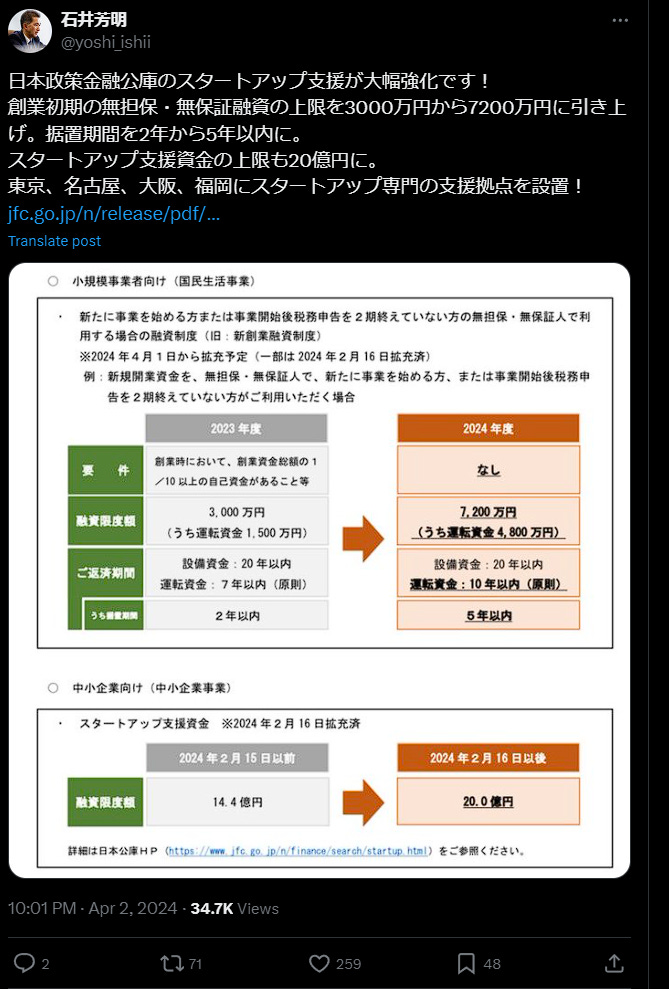

Changes in Japan, including a weak yen, low-cost financing, and government initiatives aimed at boosting investment in startups, are attracting more international attention and investment, shifting focus from domestic IPOs to global expansion and higher valuations.

Despite its modest size compared to global standards, the SV7 fund's expected net multiple of 3.5x would rank it among the top performing VC funds of similar size incepted since 2010, reflecting a strategic shift towards more hands-on involvement to enhance returns and support portfolio companies.

Japan Gov Partners with JAXA to Launch $6 Billion Space Fund

Japan's cabinet has approved a significant bill to establish a 1 trillion yen ($6.7 billion) fund aimed at propelling the country into the global race for new rocket and satellite technologies through JAXA, its national space agency. This fund, to be disbursed over the next decade, is intended to support startups, private-sector companies, and universities by providing long-term financial backing for projects difficult to commercialize in the short-run.

The initial funding of ¥300 billion yen ($1.93 billion USD) is set to be included in the upcoming supplementary budget, with allocations divided among several ministries to bolster education, economy, and communications related to space technology.

JAXA, which currently offers mainly advisory support, will begin accepting applications for funding in April, focusing on projects that align with national strategies, including security.

The government views this fund as a strategic initiative to provide consistent support for space technologies that are slow to reach commercial viability, contrasting with the current practice of annual budget requests that threaten the continuity of long-term projects.

The overarching goal is to foster public-private partnerships to accelerate space technology development, mirroring successful models in the U.S. - with a view specifically on the successful partnership between NASA and SpaceX - and to significantly grow Japan’s domestic space market to 8 trillion yen by the early 2030s.

KKR “How Japan’s Economic Reawakening Is Creating Real Estate Investment Opportunities”

KKR argues that rising wages, rents, and revenues - breaking past 30 years of deflation are revitalizing Japan’s real estate market and creating rich investment opportunities. As inflation replaces deflation and urban populations grow, the landscape is ripe for strategic engagements in various real estate sectors, particularly where local insight and relationships play a pivotal role.

Corporate Reforms and Real Estate: Enhanced shareholder value initiatives are leading companies to shed non-core real estate, opening up attractive investment avenues.

Tourism Revival: The return to pre-pandemic tourism levels, with a target of 80 million visitors by 2030, boosts demand for both luxury and budget accommodations.

Urban Growth Dynamics: Rising populations in major cities like Tokyo and Osaka create a bullish market for multifamily residences amidst a high-demand, low-supply scenario.

Strategic Investments: Identifying and investing in sectors aligned with national priorities, such as space technology, offers long-term growth potential in a transforming economy.

Word on the Street

Fundraising Highlights

Turing, a startup developing fully autonomous vehicles using generative AI, raised a ¥3B JPY (~$19.2M USD) Pre-Series A led by Anri, and participated by Dimension, NTT Docomo, Z Venture Capital, Mizuho Capital, Digital Hearts, Yanmar Ventures, Future Creation Capital

Enechain, the largest energy marketplace operator in Japan, raised a ¥2.9B JPY (~ USD 19.2M) Series B round from DCM, JPS, SMBC, Soros Capital Management, Mizuho, Mitsubishi, and Sumitomo Bank, amongst others.

Prime Number, a data integration and automation service for big data analytics, raised a ¥2B JPY (~$12.8M USD) Series B round led by Coral Capital and JPS, and participated by One Capital, SMBC, Salesforce, Mizuho Capital, Shoko Chukin Bank, Japan Finance Corporation, East Japan Bank, and Shizuoka Bank

Conocer, a next-generation digital learning school, raised a ¥500M JPY (~$3.2M USD) Series A round from Upsider Bue Dream Growth Fund

Digzyme, A Tokyo Institute of Technology startup that provides unique enzyme libraries, raised a ¥560M JPY (~$3.6M USD) Series A round led by DG Daiwa Ventures, with participation from Anri, Hero Impact Capital, Future Creation Organization, Fuji Nippon Seito, Mobile Internet Capital, and Moriroku Holdings

Xaion Data, A startup that provides a next-generation AI talent search engine, raised a ¥350M JPY (~$2.2M USD) Series A round led by SBI Investment, with participation from Angel Bridge, and SMBC Venture Capital

Payke, an app for inbound tourists that displays product information in 7 languages just by scanning the product barcode, raised an undisclosed Series C round from BOR Venture Fund

More Food for Thought

Some additional reads from the week -

Carlyle nears deal to buy KFC Japan's shares from Mitsubishi Corp (Nikkei)

Goldman Sachs Japan names Hidehiro Imatsu as President (Deal Street Asia)

JAL’s first female president aims for all employees to thrive (Asahi)

132 leading startups increase employment by 50% in 2 years Nikkei survey (Nikkei)

Stories of the 'Accenture Mafia' - Entrepreneurs from Accenture (Bridge)

Japan's Renesas learns to weather downturns in semiconductors (Nikkei)

Number of homeless in Japan hits record low (Japan Times)

Notes from the Team

Thanks for reading and hope to see you around around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)