KKR eyes Japan, Vinod Khosla on AI, and Oracle bets $8B on data centers

The yen hits 155 JPY to the USD!

A common sight across the Marunouchi district of Tokyo in April that visitors will generally come across is groups of fresh college graduates in equally freshly ironed suits acclimating themselves to office life. A contemporary tradition - but perhaps one on the way out.

Japan’s shinsotsu new graduate recruitment system has been a feature of Japan’s employment landscape for major companies for almost the last hundred years - promising stability in exchange for company loyalty. Despite its longstanding tradition, an increasing number of graduates express dissatisfaction with the system, questioning the efficacy of Japan's famed lifetime employment model.

A distinctive aspect of the system is its opaque and ambiguous nature regarding role definition - new graduates are generally hired to be members of the company they work for, rather than to fulfill a specific role. Candidates often enter the process with little knowledge of the positions they're applying for, relying on post-hiring placements within various departments.

At Softbank (where Jeremy used to work), no matter what you studied or what your background was, you worked at a Softbank retail shop selling phones for 3 months! With the exception of technical tracks at a subset of companies, anyone can be placed anywhere in the organization in any role.

A political science major, for instance, could be assigned to work in FP&A, or an economics major could be assigned to work as a systems engineer with no previous background in the field - personnel and skillsets are fundamentally viewed as fungible. Naturally, this has had significant implications for professional and skill development.

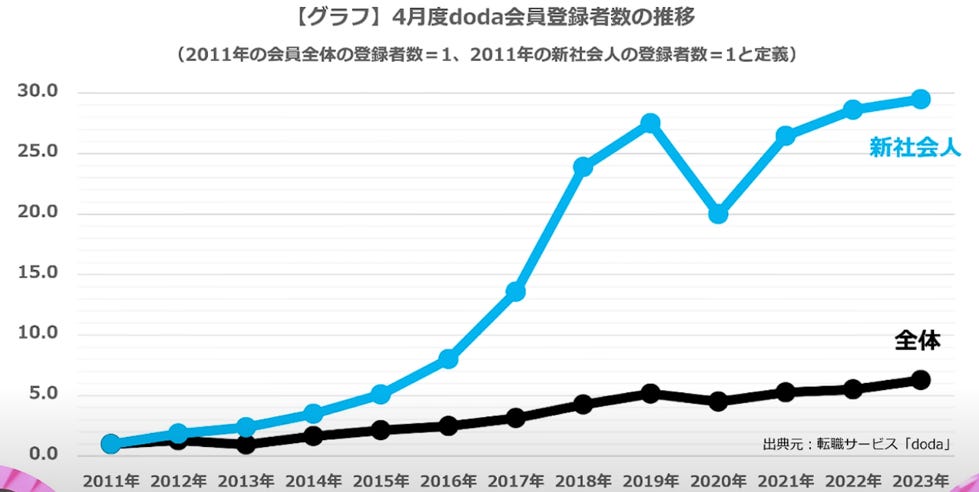

However, recent trends reveal a shifting landscape. One in four new hires in Japan now contemplate leaving if they are not assigned to their desired department. This sentiment challenges the traditional notion of lifetime employment. Furthermore, doda, a popular career changing service, indicated that the number of new graduates hires who signed up for their service in 2023 had grown by *30 times* compared to 2011, compared to an increase of 6 times in the general working population.

In general, the number of job changers in Japan has increase very incrementally over the last decade - averaging around 3 million/year - with a peak 3.5 million people in 2019. Are we due for a significant acceleration as rising prices (and wages) incentivize change, norms change, and the economy picks up post-pandemic?

The Headlines

KKR Sets Sights on Japan for Growth

Oracle Pours $8 Billion into Japan to Meet Surging AI Needs

Vinod Khosla Predicts Japan and India as Emerging AI Hubs

OpenAI triples Japanese language processing speed

Deep Dives

KKR Sets Sights on Japan for Growth

Japan is experiencing a pivotal moment in its development. After 30 years of deflation, inflation is making a comeback. Corporate reform efforts are bearing fruit, tourism is booming, manufacturing is shifting onshore, and major cities are seeing population growth. New York-based KKR said it sees the Asia-Pacific region as vital to its goal of doubling its assets under management from $553 billion at the end of December to more than $1 trillion in the next five years.

Japan has accounted for 39% of the $47 billion the firm has invested across the Asia-Pacific region since 2005, followed by India and Australia with 17% each, the firm said.

Joseph Bae, KKR’s co-chief executive states: “Companies have low valuations and big conglomerate structures with a lot of noncore businesses, leaving massive room for operational improvement, and a very low cost of capital.”

Gaurav Trehan, a partner who co-leads the firm’s Asia-Pacific said “A change in the “mindset” of Japan’s conglomerates is driving them to shed assets as they seek to streamline their operations, creating buyout opportunities for KKR”

“If you look at the Tokyo Stock Exchange, it has nearly 4,000 companies, 40% of [which] are trading below book value,” Trehan said. “Some of these are very high-quality companies with global customers, but just haven’t been managed as well.” says Gaurav.

Oracle Pours $8B into Japan to Meet Surging AI Needs

Oracle (ORCL.N), plans to enhance the capabilities of its data centers in Tokyo and Osaka by integrating high-performance graphics processing units (GPUs) specifically designed for AI development by investing more than $8 billion over the next 10 years.

The move mirrors investment strategies disclosed by other counterparts such as Microsoft Corp., who announced earlier this month it intends to invest $2.9 billion in Japan for data center upgrades. Amazon.com Inc.'s cloud computing division similarly revealed in January its plan to allocate approximately 2 trillion yen ($13 billion) in Japan by 2027 to bolster its cloud infrastructure.

The latest investment will grow the footprint of Oracle Cloud Infrastructure (OCI), the company's cloud computing service, across Japan, Oracle said in a statement.

Oracle will also expand its operations and support engineering teams with Japan-based personnel.

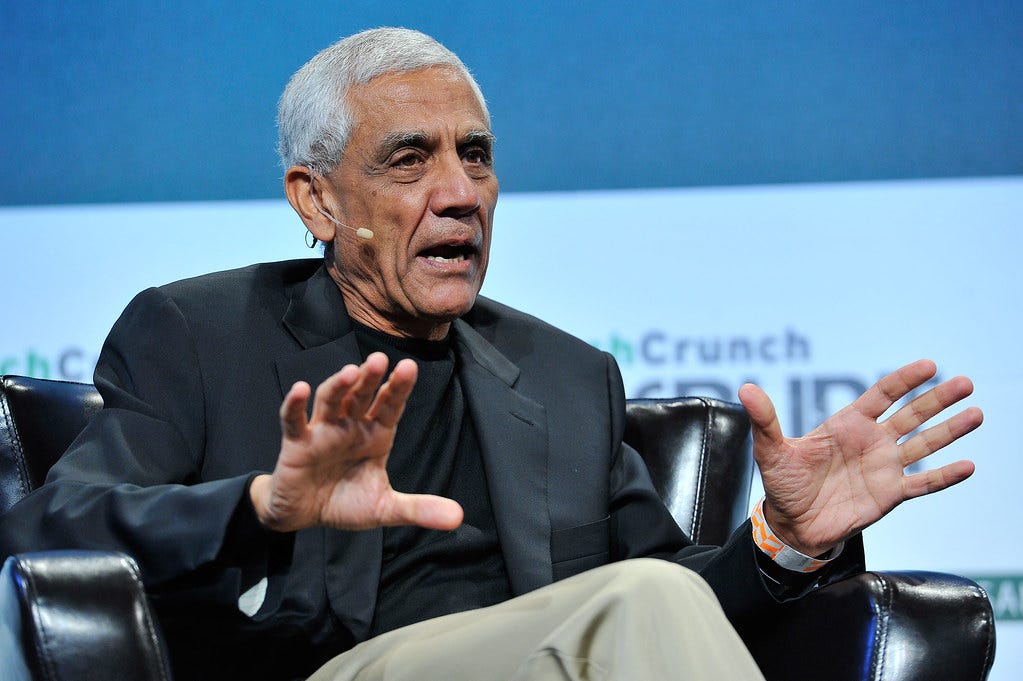

Vinod Khosla Predicts Japan and India as Next AI Hubs

Vinod Khosla, a prominent venture capitalist in Silicon Valley, highlighted in a recent interview with Nikkei that artificial intelligence advancements are varied, with expanding business prospects reaching into Asia, notably India and Japan.

This comes as businesses see Japan as one of the world’s most AI-friendly countries in regard to copyright law.

As of January 1, 2019, Japan's updated Copyright Act took effect. The implementation of Article 30-4 grants extensive permissions for the ingestion and utilization of copyrighted content across various information analyses, including AI model training.

"I think regionalization will help the world and it will protect against one company dominating globally,"Khosla remarked. He added that local AI model providers could greatly streamline the training and utilization of generative AI, leading to increased efficiency and lower costs.

Khosla also emphasized the importance of the West and some Asian countries taking the lead in the AI development race in the face of competition from China.

OpenAI triples Japanese language processing speed

OpenAI is poised to unveil an upgraded iteration of its core large language model, boasting triple the Japanese language processing capabilities. The objective is to compete with analogous services currently in development by Japanese firms.

Japan is an important market" for OpenAI, Chief Operating Officer Brad Lightcap told reporters Monday as the company opened its Japanese subsidiary in Tokyo. Lightcap also presented a customized large language model specifically optimized for Japanese during a news conference.

OpenAI's extensive language model wasn't initially tailored for Japan, yet it has already demonstrated impressive proficiency in the Japanese language. According to a Japanese proficiency index for large language models published by Weights & Biases, the top four positions are held by OpenAI models.

Japanese giants like NEC, NTT, and SoftBank Group, along with startups like Elyza from the University of Tokyo, are delving into Japanese-language generative AI. Yet, none have matched OpenAI's prowess. While some Japanese models claim language proficiency akin to older OpenAI versions, they fall short in overall capability states the Nikkei.

Word on the Street

Fundraising Highlights

Landit, a a parking lot optimization platform, raised a ¥800M JPY (~$5.1M USD) Series A round lead by WiL, and participated by Axiom Asia Private Capital

Zehitomo, a professional freelance marketplace, raised an undisclosed Series C round from Darwin Venture Management, DG Daiwa Ventures, Cocoa Investment, and Resona Capital

goooods, a machine learning-based B2B commerce platform, raised a ¥670M JPY (~$4.3M USD) Series A round lead by Angel Bridge, and participated by Incubate Fund US, Vela Partners, and XTech Ventures

Sharing Energy, a service that allows you to install and use a Photovoltaic (PV) system, raised a ¥4B JPY (~$25M USD) Series B round from AG Capital, GMO VenturePartners, TIS, Mizuho Bank, Sumitomo Bank, amongst others

Resilire, a SaaS based supply chain risk management platform, raised a ¥620M JPY (~$3.9M USD) Series A round lead from Dnx Ventures, and participated by Archetype Ventures and Deep Core

Robot Consulting, a AI automation tool for the legal industry, raised a ¥1B JPY (~$6.4M USD) Series B round from Tokyo wells.

Wanget, a startup that operates a video production cloud service, raised an undisclosed Series B round from Relic

More Food for Thought

Some additional reads from the week -

An AI star seeks to bring self-driving cars to Japan by 2030 (Japan Times)

Japan's Sakura Internet snags $130m of Nvidia's next-gen chip (Nikkei)

Japan Post Bank to invest in startups helping revive regional areas (NHK)

Toshiba to cut 5,000 jobs in latest bid to restructure (Business Times)

Japan foreign tourists top 3m in March, fueling record spending boom (Nikkei)

Nvidia to help Japan's AIST build quantum supercomputer (Digitimes Asia)

Hidden billions in Tokyo real estate lure activist hedge funds (Japan Times)

Notes from the Team

Thanks for reading and hope to see you around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)