Osaka Rises, Semiconductors, and Cross-border Investment

Also OpenAI officially kicks off its first APAC office in Japan!

Following up on last week’s slightly counter-intuitive fun fact on population aging - Japan actually having the highest birth rates in East Asia outside of North Korea - this week we’ll be discussing another key aspect of demographics: immigration!

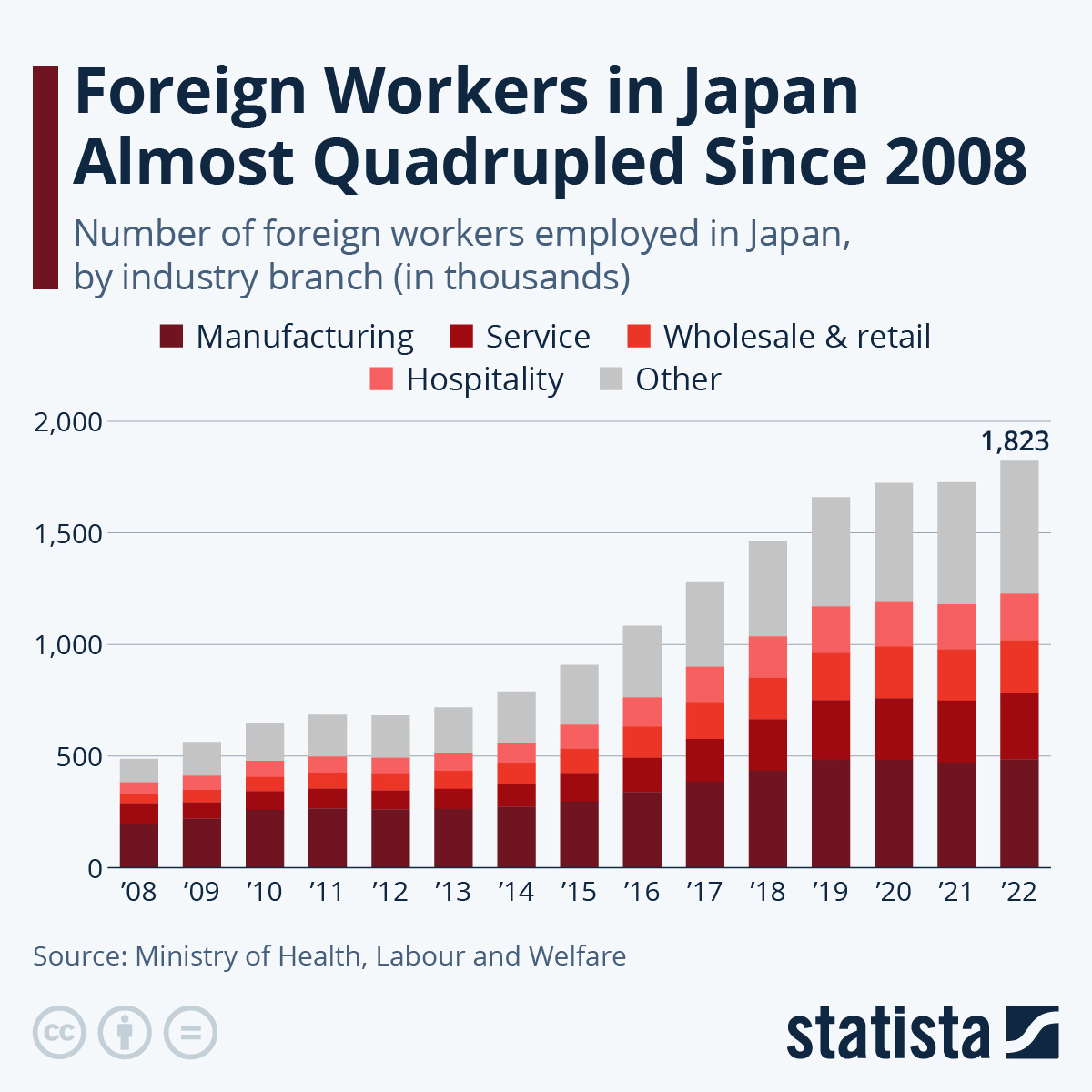

Contrary to popular perceptions of Japan, getting a visa to work in Japan is actually relatively easy - in most cases, a bachelor’s degree and a job offer is sufficient. This, along with increased recruitment of workers from abroad has led to a dramatic increase in foreign workers - quadrupling since 2008 and more than doubling since 2015 to 2.05 million in 2023, slowed only by the COVID-19 pandemic.

A few other statistics to chew on:

The number of foreign residents in Japan reached 3.4 million by the end of 2023 - increasing by 336,000 - roughly 10% y-o-y - from the previous year.

The composition of foreign residents is quickly evolving - with the majority being nationals of neighboring states at the end of 2023: China (821,838), Vietnam (565,026), South Korea (410,156), the Philippines (322,046), Brazil (211,840), Nepal (176,336), Indonesia (149,101), Myanmar (86,546), Taiwan (64,663), and the United States (63,408).

51.9% of foreign residents are in their 20s/30s - much younger than the general population.

The Headlines

Osaka Climbs to Second Nationwide in Startup Funding

New York Stock Exchange trying to get Japanese companies to list in the U.S.

Microsoft to invest $2.9 billion to boost AI and cloud in Japan

Japan outspends U.S., Germany on chip subsidies as share of GDP

Deep Dives

Osaka Climbs to Second Nationwide in Startup Funding

In 2023, Osaka rose to second place nationwide in startup funding (JPN) - only behind Tokyo - achieving its highest ranking in nine years due to several substantial funding rounds. According to Initial, a startup database, total funding for startups in Osaka surged to 237 billion yen (~$1.53B USD), marking a 23% increase from the previous year, while most other prefectures saw declines in funding.

Despite economic challenges underscored by rising interest rates in Japan, Osaka's startups managed to secure significant investments, partly because they offered more cost-effective opportunities compared to Tokyo.

Notable funding achievements in Osaka included a 1.8 billion yen investment in EX-Fusion, which is pioneering nuclear fusion energy; Fullkaiten, a stock analysis cloud service, which secured approximately 1.1 billion yen; and Nexta, a manufacturing management system developer, which raised around 400 million yen.

Looking ahead to 2024, the investment climate for startups in the Kansai region is expected to remain resilient, with potential growth driven by academia-linked startups, as universities continue to play a pivotal role in enhancing the startup ecosystem.

There is a growing focus on intensifying support for startups through enhanced collaboration between industry, government, and academia, reflecting an increasing investor interest in the region's startups.

The New York Stock Exchange trying to get Japanese companies to list in the U.S.

The New York Stock Exchange (NYSE) is actively engaging with a diverse group of Japanese companies that are considering U.S. listings within the next 18 months, highlighting a significant international interest in the American financial markets. This engagement, discussed by the NYSE's Vice Chairman John Tuttle in Tokyo, involves companies primarily from the technology and healthcare sectors, which are rapidly expanding and exploring opportunities beyond local markets.

Japanese companies are attracted to the U.S. market due to its large pool of institutional investors and the advantage of having U.S.-dollar denominated shares.

The global investment outlook on Japanese stocks has become more positive, driven by expected improvements in shareholder returns and a weaker yen, which has particularly benefited exporters.

Despite the capacity of Japan’s local markets to support capital needs, the broader and more diverse investor base in the U.S. remains a compelling reason for Japanese startups to pursue listings in the U.S.

The trend of seeking U.S. listings is not limited to Japanese companies, with firms from South Korea, Indonesia, and Singapore also showing interest in accessing the dynamic U.S. financial ecosystem.

Microsoft to invest $2.9 billion to boost AI and cloud in Japan

Microsoft plans to invest $2.9 billion to enhance its hyperscale cloud computing and artificial intelligence infrastructure in Japan, marking its largest investment in the country to date. This announcement was made during a visit by Japanese Prime Minister Fumio Kishida to the United States, emphasizing the strengthening economic and technological ties between the two nations.

The investment aims to bolster AI and robotics capabilities, including the opening of a new lab in Japan, and expand digital training programs to equip over 3 million people with AI skills within three years.

Microsoft's initiatives also involve deepening cybersecurity collaborations with the Japanese government, highlighting the strategic importance of technology in bilateral relations.

PM Kishida's visit to the U.S. includes discussions on economic security and key technologies with U.S. leaders, alongside advocating for increased U.S. investment in Japan, particularly in sectors like semiconductors and quantum computing.

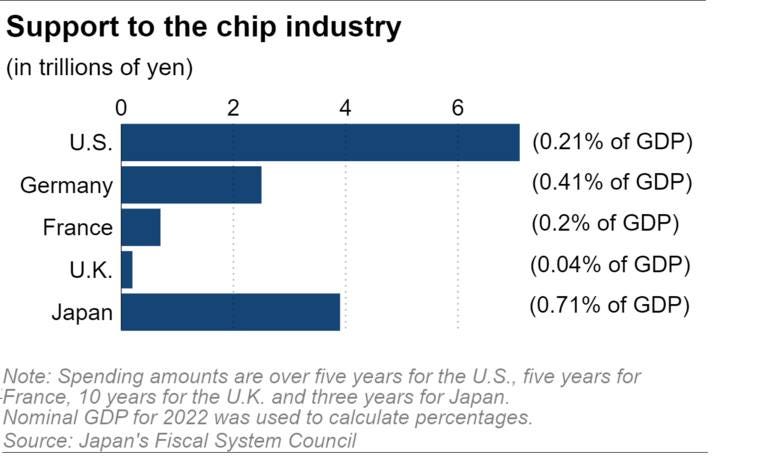

Japan outspends U.S., Germany on chip subsidies as share of GDP

Japan is investing substantially more in its semiconductor sector relative to its GDP compared to the U.S. and other major Western nations, dedicating 3.9 trillion yen over three years, which represents 0.71% of its GDP. This commitment was highlighted during a meeting of a subcommittee of Japan's Fiscal System Council, emphasizing the strategic importance of semiconductors in the global economy and national security.

Japan's relative investment in the semiconductor industry significantly outpaces that of the U.S (0.21% of GDP), France (0.2% of GDP), and Germany (0.41% of GDP).

The funding challenges in Japan include sourcing sufficient financial backing for these investments, with only a portion currently covered by funds such as GX bonds aimed at supporting green transformation.

The subsidies are funded primarily through supplementary budgets, which can be approved faster than the initial budget.

Japanese experts and government officials are advocating for more predictable, long-term planning in semiconductor investments to enhance stability and confidence among private sector investors.

Word on the Street

Fundraising Highlights

MTU, a medical security support service, raised a ¥450M JPY (~$2.9M USD) Series A round from the 90s1 Investment, D4V, and the Iceblue Fund.

Blue Planet Works, provider of “App Guard” a security tool that prevents endpoints from being compromised by advanced cyber attacks, raised Series D round of an undisclosed amount from the Japan Hospital Mutual Aid Association.

Elestyle, developers of "elepay", a multi-payment platform that promotes cashless payments, raised a ¥1B JPY (~$6.5M USD) Series B round from the SAI Global Japan Fund I, and Mitsui Sumitomo Bank.

Folio, a service that allows anyone to easily manage their personal assets, raised a ¥1B JPY (~$6.5M USD) Series E round from Okasan Capital Partners.

Sanu, a service that allows anyone to easily manage their personal assets, raised a ¥7B JPY (~$46.1M USD) Series A round from SDF Capital, Siiibo Securities, Mizuho Bank, Resona Bank, and Shoko Chukin Bank.

Infcurion, a digital wallet service that provides smartphone payment, remittance, and coupon functions linked to bank accounts, raised a ¥1.9B JPY (~$12.5M USD) Series C round from JR West Innovations, QR Investment, S Ventures, Hokkoku Financial Holdings, Japan Finance Corporation, Shizuoka Capital, and Shizuoka Bank.

Pictoria, a startup that operates the world's first AITuber office "AI CAST", raised a ¥199M JPY (~$1.31M USD) Series A round from the Sony Innovation Fund.

More Food for Thought

Some additional reads from the week -

Indonesian VC recommends Tokyo IPO amid Japan stock boom (Nikkei Asia)

OpenAI explores collaboration with Japan's semiconductor industry (Nikkei Asia)

Ex-Google AI Experts Bet on Untapped Japan Market (Bloomberg)

Japan reaps the benefits from US-China tech war (Asia Tech Review)

Japan targets India and Southeast Asia to recruit tech workers (Nikkei Asia)

Toyota Ventures gets $300m injection (Global Corporate Venturing)

Notes from the Team

Thanks for reading and hope to see you around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)