Manga Mania!

Fun Fact: 40% of all publications sold in Japan are manga

We were curious exactly how large the market for Japanese manga was, so we looked it up this week - and it’s massive.

Total manga sales in Japan reached a record high of 677 billion yen (around $5 billion) in 2022.

Manga's share of the publishing market rose to 41.5% in 2022, up 1.1 percentage points from the previous year

Manga publishers lost an estimated $2.4B in 2023 to piracy, attracting increasing legal and regulatory action.

Industry estimates indicate a CAGR of 14-18% for the next decade - brisk growth given the existing

The prospects of the manga industry have also attracted increasing attention from deal makers and others abroad - most recently:

Blackstone Agrees to Buy Japanese Online Manga Firm for $1.7 Billion

Blackstone will acquire Teijin’s controlling 55.1% stake in Infocom

Infocom shares have surged about 96% this year, valuing the firm at about $1.8 billion.

In any case - back to the fundraising announcements and news of the week!

The Headlines

Japan to shift $640bn in public pension money into active investing

Japan space-debris cleaner Astroscale valued at $1bn in market debut

Japan looks to minimize economic fallout of auto-test falsifications

Qatar sovereign fund has 'very high targets' in Japan

Deep Dives

Japan to shift $640bn in public pension money into active investing

Japan is set to steer nearly 100 trillion yen ($638 billion) of public money into active investing, inspired by the Government Pension Investment Fund's (GPIF) approach to riskier assets. This move aims to enhance Japan's asset management sector, with a focus on boosting market presence and diversifying investments.

The initiative includes civil servants' retirement savings, adding another significant player to stock and bond markets.

Prime Minister Fumio Kishida aims to improve asset management at nine public asset owners managing approximately 300 trillion yen, including the GPIF.

Measures will include hiring more investment professionals and diversifying asset allocations, as recommended by ruling Liberal Democratic Party lawmakers.

Affected funds include the Federation of National Public Service Personnel Mutual Aid Associations (KKR) with 10 trillion yen in assets, the Pension Fund Association for Local Government Officials with 30 trillion yen, and the Promotion and Mutual Aid Corporation for Private Schools of Japan with 5 trillion yen.

Japan space-debris cleaner Astroscale valued at $1bn in market debut

Japanese space debris remover Astroscale achieved a market valuation of $1 billion in its debut on the Tokyo Stock Exchange's startup section, reflecting investor excitement, a rising Japanese government space budget, and interest from the Defense Ministry over the space sector amid geopolitical competition.

Shares of Astroscale closed at 1,375 yen - more than 60% above the initial offering price of 850 yen.

Astroscale's valuation reached 155.4 billion yen ($1 billion) on its first day of trading, signaling strong investor interest in the space industry.

The successful IPO follows the public listings of other space startups like ispace and iQPS, indicating high investor expectations for the sector's growth.

Astroscale specializes in space debris removal technology, having completed successful demonstration missions and secured a contract with JAXA for a debris removal mission in 2026 or later.

The IPO raised 17.6 billion yen ($113 million) for Astroscale, which will be used for technology development and operational expenses, with the company also exploring other business lines like satellite refueling.

Japan looks to minimize economic fallout of auto-test falsifications

Chief Cabinet Secretary Yoshimasa Hayashi stated that the impact of recent "fraudulent activity" in the Japanese auto industry is likely to be "minimal." The government will take steps to minimize economic damage caused by data falsification disclosed by five companies, including Toyota and Mazda, which have halted production of four models due to testing procedure shortfalls.

Toyota halted production of Corolla Fielder and Corolla Axio models at plants in Miyagi and Iwate, expecting the pause to last until June 28. The Yaris Cross will continue production for export only.

Mazda stopped production of the 1.5-liter Mazda 2 and 1.5-liter Roadster RF at its Yamaguchi and Hiroshima plants, with the duration of the stoppage pending advice from the transport ministry.

Five companies, including Honda, Yamaha, and Suzuki, admitted to falsifying testing data or improperly testing vehicles, affecting a total of 38 models.

Government inspectors have begun reviewing materials and conducting interviews at Toyota’s headquarters. The Ministry of Land, Infrastructure, Transport and Tourism will investigate the data falsifications and work to contain the economic impact.

Qatar sovereign fund has 'very high targets' in Japan

Qatar Investment Authority (QIA) views Japan as a "key market" and is actively seeking new opportunities there, according to Abdulla Ali al-Kuwari, head of Asia-Pacific investments for the fund. Since opening a Singapore office in 2021, QIA has more than doubled its investments in Japan.

QIA, established in 2005 and estimated to manage over $500 billion in assets, has significantly increased its investments in Japan since 2020, including a notable 5% stake in Kokusai Electric worth about 50 billion yen.

Al-Kuwari emphasized the importance of Japan to QIA's strategy, noting a dedicated and expanding team focused on the country, and a flexible approach to the size of individual investments based on opportunity.

QIA sees potential in sectors such as semiconductors, manufacturing, real estate, and financial institutions, keeping a close eye on interest rate developments.

The fund's investment strategy is guided by long-term perspectives, financial investment without operational roles, and strong partnerships, as it continues to diversify Qatar's economy away from reliance on liquefied natural gas and oil.

Word on the Street

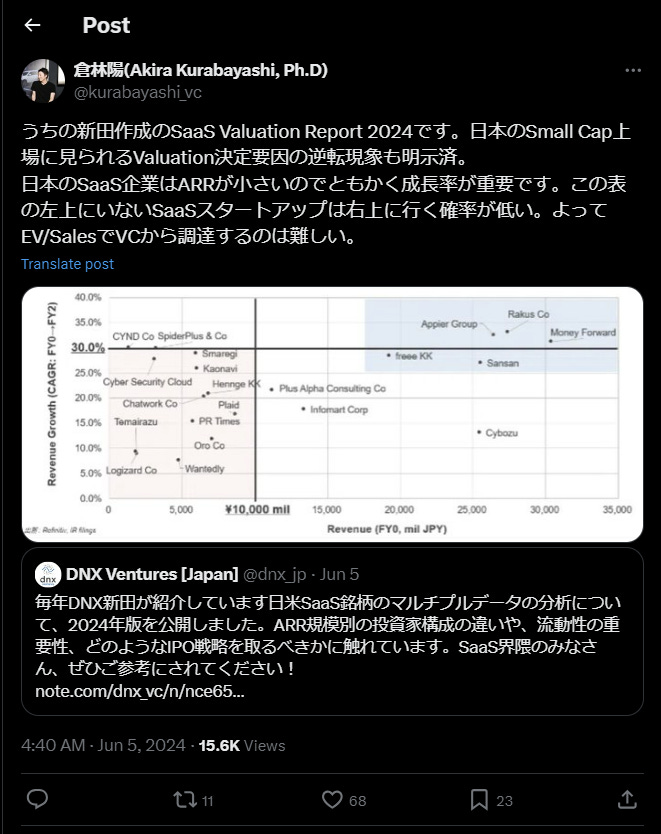

“This is the SaaS Valuation Report 2024 created by Nitta on our team. It also clearly shows the reversal of valuation determinants seen in Japanese small cap listings. Japanese SaaS companies have a small ARR, so the growth rate is important.

SaaS startups that are not in the top left of this table have a low chance of moving to the top right. Therefore, it is difficult to raise funds from VCs on EV/Sales.”

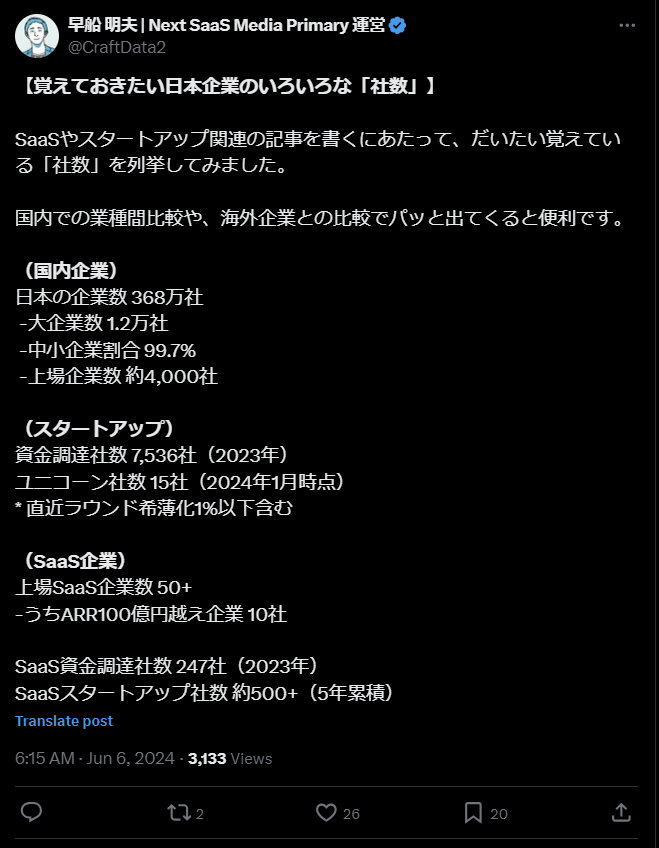

“[Various "numbers" of Japanese companies you should remember] As I write articles related to SaaS and startups, I have listed the number of companies that I can remember.

It is useful for quickly comparing different industries within Japan or with overseas companies. (Domestic companies)

Number of companies in Japan: 3.68 million

-Number of large companies: 12,000

-Small and medium-sized enterprises: 99.7%

-Number of listed companies: Approximately 4,000 (Startup)

Number of companies raising funds: 7,536 (2023)

Number of unicorns: 15 (as of January 2024)

*Includes most recent round dilution of less than 1% (SaaS company)

Number of listed SaaS companies: 50+

-10 companies with ARR of over 10 billion yen

Number of SaaS companies funded: 247 (2023)

Number of SaaS startups: Approximately 500+ (5-year cumulative)”

Fundraising Highlights

Last week was a bit slow due to the Golden Week holiday

Novingo Pharma, a Kyushu University startuo that develops and sells next-generation transdermal formulations, raised an undisclosed Series A round from JMTC Healthcare, Mirai Creation, and Nissin EM.

Yamap, a mountaineering app and web service, raised a ¥600M JPY (~$3.8M USD) Series D round from 15th Rock Ventures, SG Incubation, Iyogin Capital, ZENRIN Future Partners Fashion & Technology Investment Partnership No. 2, Sumitomo Mitsui Trust Bank, Marui Group, Yamanashi Chuo Bank Management Consulting, and Fukuoka Bank.

Nihon Agri, Agri-startup whose main business is exporting Japanese agricultural products, raised a ¥1.6B JPY (~$10.6M USD) Series C round from 31 Ventures, Shinkin Yaramaika Investment, Hakuhodo, Keio Innovation Iitiative, Gunma Regional Co-Creation Partners, and others.

Skymatix, a cloud-based drone surveying service, raised an undisclosed Series B round from Toyota.

Exorphia, a startup that providesan analytical technology that quantitatively evaluates purified, raised an undisclosed Series A round from Kyoritsu Holdings.

Link-Us, an ultrasonic vibration welding machine manufacturer , raised an undisclosed Series C round from JPS Growth Investment, Kepple Liquidity, and Miyako Capital (Kyoto University).

More Food for Thought

Some additional reads from the week -

Uber CEO calls for Japan to allow independent rideshare drivers (Mainichi)

Japan's DMM Bitcoin says over ¥48 billion of cryptocurrency lost (JT)

Costco's Japan wages provide pathway to firing up nation's low pay, economy (Reuters)

What I learned about dealmaking (and mascots) in Japan (Fortune)

Japan's Fintech Awakening: Navigating Demographic Shifts With Financial Technology (Forbes)

Feeling flush: Japan's high-tech toilets go global (Japan Today)

Apple to add Japan's 'My Number' ID card function to iPhone, Japan official says (Reuters)

Notes from the Team

Thanks for reading and hope to see you around around the sidewalks of Tokyo!

Have a question or any feedback? Let us know!

Jeremy (Investor @ GHOVC) / Kenneth (Product @ Moon Creative Lab)